38.8% of respondents in India (29.6% in Asia Pacific) said domestic B2B customers pay invoices late intentionally, to use trade credit as a way of alternatively financing their business operations.

Survey results for India

Sales on credit terms

Around 98% of respondents in India reported having granted trade credit to their domestic and foreign B2B customers over the past year. This response rate, which is well above that for Asia Pacific (91%), is the highest in the region.

Contrary to what was observed in Australia and Japan (where around one in five survey respondents reported no sales on credit terms), Indian respondents displayed the most liberal stance towards the use of trade credit in B2B transactions of the countries surveyed in the Asia Pacific region. This frequent use of trade credit in B2B transactions in India, like in Hong Kong, likely reflects both working capital financing conditions and the types of firms in these countries (there is a prevalence of small firms strongly dependant on trade credit as a less costly source of short-term financing than bank borrowing).

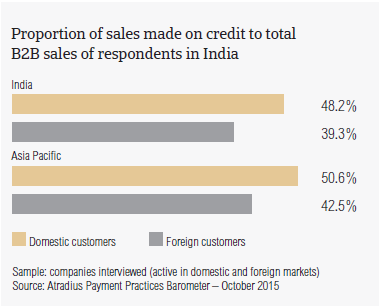

A breakdown by percentage indicates that, on average, respondents in India are more inclined to sell on credit to B2B customers domestically than abroad. This is consistent with the survey pattern. Domestically, credit-based sales average 48.2% of the total value of local B2B sales, slightly lower than the 50.6% average for Asia Pacific. A similar outcome was observed in terms of foreign B2B sales, which averaged 39.9% of the total value of Indian respondents’ exports, again, a slightly lower figure than the regional average of 42.5%. These survey results indicate that Indian respondents and almost all respondents in the countries surveyed in Asia Pacific (except for respondents in Australia), do not have a uniform perception of payment default risks arising from domestic and foreign B2B trade.

Compared to 2014, the average proportion of credit sales to domestic B2B customers in India increased slightly (by an average of 3.2 percentage points). This is in line with the average increase recorded in Asia Pacific over the same time frame. The proportion of credit-based sales to foreign customers varied more markedly. After a sharp drop one year ago, it increased again in 2015, and is now slightly lower than 2013 levels. This corresponds to an average 9.4 percentage point increase, which is almost twice that of the increase at regional level.

Average payment term

Respondents in India give their domestic and foreign B2B customers payment terms averaging 29 days from the invoice date. These terms are below the 33 days average for Asia Pacific, and are the third shortest in the region, after those recorded in Indonesia and Australia.

Over the past two years, both the domestic and foreign payment terms in India appeared to be shorter by an average of five days.

Overdue B2B invoices

97% of respondents in India (significantly above the 90.2% of respondents in Asia Pacific) reported having experienced late payment of invoices by their B2B customers over the past year. This is the highest percentage of respondents of all the countries surveyed.

The difference between the average speed of payment from the domestic and foreign B2B customers of Indian respondents, and the average for Asia-Pacific, is notable. Domestic B2B customers of respondents in India paid invoices late more often than foreign customers did. An average of 53.5% of the total value of domestic, and 49.6% of the total value of foreign B2B invoices remained outstanding after the due date. In both cases, the averages for Indian respondents are notably higher than those for Asia Pacific (44.8% domestic and 45.2% foreign). The domestic figure is the highest of the countries surveyed.

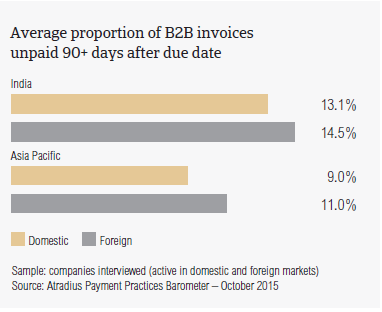

Receivables unpaid after 90 days or more averaged 14% of the total value of domestic and foreign invoices respectively (average for Asia Pacific: around 10%). The proportion of long outstanding receivables from foreign B2B customers is almost as high as that from domestic customers. This is in contrast to the survey pattern, where the proportion of long overdue foreign invoices outweighs that of long overdue domestic invoices.

An indication that, on average, B2B customers of Indian respondents are not paying invoices on time is given by the Days Sales Outstanding (DSO) figure posted by respondents in the country. This averages 35 days (in line with the regional average) and is almost half that observed last year. Moreover, it may reflect fluctuation in credit sales, or the fact that businesses interviewed in India have more outstanding receivables of greater value, that are quickly paid by customers.

Average payment delay

Domestic and foreign B2B customers of respondents in India pay past due invoices, on average, not later than 34 days after the due date. This average is higher than those for the region (25 days domestic and 28 days foreign). This means that, if not paid on time, suppliers in India receive payment on domestic and foreign B2B invoices, on average, around 63 days after invoicing. The average payment duration for the region stands at 59 days for domestic invoices and 61 days for foreign ones. The domestic figure observed in India is the longest in Asia Pacific.

Over the past year, both the average domestic and foreign payment delay figures in India increased, as did the overdue payment levels. B2B customers of Indian respondents appeared to delay payments due to various reasons, which will be commented on further in this report (see below ‘Key payment delay factors’).

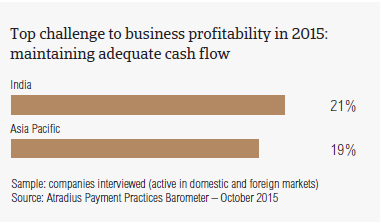

Late payments of invoices incur financial and administrative costs and can negatively affect cash flow and business growth. This may explain why most of the respondents in India (nearly 21%, almost as many as in Asia Pacific) consider maintaining adequate cash flow to be one of the biggest challenges this year.

Notably more respondents in India (17%) than in Asia Pacific (11.9%) consider the efficiency of receivables management and the collection of outstanding invoices (15.5% of respondents in India versus 9.8% in Asia Pacific) the main challenges for 2015. These findings suggest that Indian respondents are much more concerned with receivables management and collection than their peers in the region.

Key payment delay factors

Most of the respondents in India (just over 50%) reported that late payment from domestic B2B customers is chiefly due to liquidity issues. This is above the 46.3% average for respondents in Asia Pacific, and is the second highest response rate in the region, after that in China. Notably more respondents in the country (38.8%, compared to 29.6% in Asia Pacific) stated that the late payment of invoices is intentional, as domestic B2B customers use trade credit as a way of alternatively financing their business operations. Inefficiencies of the banking system was also much more frequently noted by respondents in India in respect to late payment of domestic invoices (28% of respondents, versus 19.6% for the region).

In relation to late payment of foreign invoices, the most often reported reason for payment delay is the complexity of the payment procedure (nearly 43% of respondents, compared to 39.5% at regional level). Liquidity issues and the inefficiencies of the banking system are the second most often cited delay factors (around 35% of respondents each).

Uncollectable accounts

2.2% of the average total value of B2B receivables in India, slightly above the 2.0% regional average, was reported by respondents as uncollectable. Consistent with the survey pattern, domestic write-offs outweigh foreign ones. This is likely due to cultural and language differences in international trade. Uncollectable B2B receivables were primarily reported as coming from the chemicals, construction, consumer durables, electronics, and financial services sectors.

For most of the respondents in India (50%), B2B receivables went uncollected due to the customer being bankrupt or out of business. This compares to 54.4% of respondents in Asia Pacific. Nearly two in five respondents said that B2B receivables could not be collected due to the failure of collection attempts (38.6% of respondents in Asia Pacific).

Consistent with the response rate at regional level, around 35% of respondents said that B2B receivables were written off as uncollectable because the customer could no longer be located or the debt was too old.

To learn more about the B2B receivables collections practices in India, please see the Global Collections Review by Atradius Collections (free download after registration), available from 28 October 2015 on atradiuscollections.com

Payment practices by industry

Respondents in India reported having granted trade credit terms mainly to B2B customers belonging to the chemicals, construction, consumer durables, electronics, machines, metals, and services (financial and business services) sectors. The longest payment terms, averaging 35 days from the invoice date, are given to domestic and foreign B2B customers in the construction sector.

Domestically, the construction and machines sectors record the highest levels of late payments. Over three-fifths of the total value of B2B invoices in both sectors were paid after the due date. The same level of overdue payment was attributed to foreign B2B customers.

Liquidity issues were the most frequently reported reason for domestic payment delays in the electronics and metals sectors (just over 60% of respondents in each of the two sectors). 35% of respondents in the consumer durables and machines sectors said that late payment from domestic B2B customers was most often due to the buyer using outstanding invoices as an alternative form of financing.

Invoice payment delay from foreign buyers due to complexity of the payment procedure occurred most often in the chemicals sector (52% of respondents). Foreign customers in the consumer durables sector most often delayed invoice payment due to liquidity issues (47% of respondents) while customers in the construction and machines sectors due to the inefficiencies of the banking system (40% of respondents).

Around one in five respondents in India said that they do not expect any change in the payment behaviour of domestic B2B customers over the coming 12 months. 30% anticipate a worsening, particularly in the consumer durables and electronics sectors. 47% of respondents expect an improvement in the payment behaviour of domestic customers, particularly in the chemicals and machines sectors.

As to the payment behaviour of foreign B2B customers, one in four respondents in India anticipate no significant variation over the coming 12 months. 20% anticipate a worsening, particularly in the construction sector. Over half of the respondents expect an improvement, chiefly in the machines and services sectors.

For more insights into the overall payment practices in each of the countries surveyed in Asia Pacific, please refer to the respective country reports which form, along with the regional report, the 2015 edition of the Atradius Payment Practices Barometer for Asia Pacific. Free download on atradius.com

Related documents

3.14MB PDF

3.01MB PDF

34KB PDF